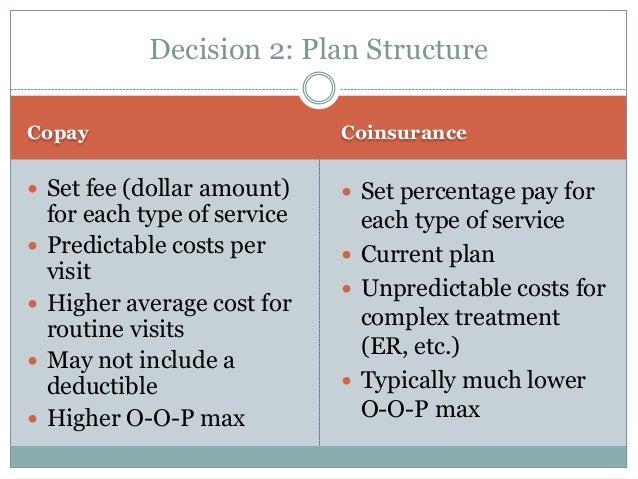

If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259. Part A hospital inpatient deductible and coinsurance. Kies program. You pay: $1,484 deductible for each benefit period. Days 1-60: $0 coinsurance for each benefit period. Days 61-90: $371 coinsurance per day of each benefit period. Depending on how your plan works, what you pay in copays may count toward meeting your deductible. Coinsurance What is coinsurance? Coinsurance is a portion of the medical cost you pay after your deductible has been met. Coinsurance is a way of saying that you and your insurance carrier each pay a share of eligible costs that add up to 100 percent.

It is important to understand how your health care plan operates, but far too often the tricky benefit jargon of “deductible, coinsurance, copay, and out-of-pocket max” get in the way. These hard to understand health care vocabulary terms are explained below to help make understanding your health care plan much simpler!

Deductible – the amount of out-of-pocket expenses you pay for covered health care services before the insurance plan begins to pay.

| HSA-Eligible Plan | All covered services require you to meet your deductible first and then services will be covered through coinsurance. |

| PPO Plan | Some covered services require you to meet the deductible first, while other covered services are paid with a copay. |

| Helpful Hint! | The health plan comparison chart shows deductible amounts for Tier 1, Tier 2 and Tier 3, but you should think of your deductible as one sum of the money you have paid for your services. |

| Example | With a $1500 Tier 1 deductible on the HSA-Eligible Plan with single coverage, you pay the first $1500 of covered services yourself. If you have met this, you would pay an additional $100 towards your services and then would have met the Tier 2 deductible of $2,500. |

Coinsurance – the percentage of cost of a covered health care service you pay once you have met your deductible.

| HSA-Eligible and PPO Plans | For services covered by “coinsurance after deductible” the amount you pay in co-insurance continues to count towards meeting your next Tier deductible. |

| Coinsurance % | Most Tier 1 services are covered at “90% coinsurance after deductible,” while Tier 2 services are “75% after deductible and Tier 3 are “60% after deductible.” |

| Example | If you are on either plan and have hit your Tier 1 deductible and visit a Tier 1 urgent care provider, the plan covers that service at “90% coinsurance after deductible.” This means you will pay 10% of the cost of the visit and your insurance will cover the remaining 90%. The 10% you pay will count towards your deductible. |

Copay – a fixed dollar amount you must pay to a provider at the time services are received.

| PPO Plan | Only the PPO Plan offers a copay option for specific covered services. Your copay does not count towards your deductible. |

| Copay Amounts | Copay amounts vary based on the plan design. The health plan comparison chart is the best resource to understand what your copay is for a covered service within any of the tiers. |

| Example | If you are on the PPO plan and you see a Tier 1 provider for a standard sick visit, then your copay at the time of the visit will be $20. If you seek a Tier 1 provider for physical therapy, then your copay will be $35. |

Out-of-Pocket Max – the maximum amount you pay each calendar year to receive covered services after you meet your deductible. Once you meet your out-of-pocket maximum, the Plan pays 100% of covered services you receive. In network and out-of-network services are subject to separate out-of-pocket maximums.

| HSA-Eligible and PPO Plans | Your out-of-pocket max is the summation of everything you have paid for your medical services received; this includes deductible, coinsurance and copay. |

| Helpful Hint! | Out-of-pocket max’s are determined by coverage level (single vs plan with dependents) and salary. On the health plan comparison chart you will see multiple rows with Out-of-Pocket Max figures, so be sure to look in the row that pertains to your situation. |

Health insurance is a contract between you and your insurance company.

Employer-provided health insurance is everyone’s dream.

Health insurance helps pay for health care. It helps cover services ranging from doctor visits to major medical expenses related to illness or injury.

Health insurance is a means for financing a person’s healthcare expenses. The majority of people have health insurance through an employer.

There are many different factors that need to be considered when looking at health insurance cost. What are your family’s healthcare needs and what can you afford?

Cheap health insurance usually means for people the lowest monthly premium. The lowest cost plans are also the skimpiest plans.

Copay Coinsurance Medicare

Individual health insurance is insurance you buy on your own not through an employer or association.

Rising healthcare costs and the desire to maintain profits is driving insurers and employers to shift more and more of the burden to policyholders through higher premiums, de

Cost sharing refers to the share of costs that you have to pay out of your pocket for health care services your insurance approves.

The terms in-network and out-of-network appear in all health insurance plans.

The deductible is the amount you have to pay first, before your health insurance plan pays.

Out-of-pocket maximum (OOPM) is the most you have to pay for covered medical services in a plan year.

An Explanation of Benefits (EOB) is a statement your health insurance company sends you showing how much was billed, how much they paid and how much you are expected to pay.

Think your health insurance will protected you from surprises? Think again.

Everyone wants to stay healthy. But sometimes we need a hand.

Depending on the type of health insurance you buy, your care may be covered only when you see a network provider.

Managed care plans are a type of health insurance. These plans focus on managing the care of members.

Grandfathered health insurance plans are those that were in existence before the Affordable Care Act was signed into law on March 23, 2010 and have stayed basically the same.

A Consumer-Driven Health Plan (CDHP) is supposed to encourage employees to make informed decisions and spend healthcare dollars wisely.

Catastrophic health insurance plans come with considerable risk. You should give them a lot of thought before deciding.

Short-term health insurance plans were intended for people who experienced a temporary gap in health coverage.

Health Savings Accounts (HSAs) are accounts individuals can use to set aside money to help cover medical expenses associated with High Deductible Health Plans.

The COVID-19 pandemic has shut down most employers’ efforts to experiment with ICHRAs as a new type of benefit plan.

A Flexible Spending Account is a special account setup by your employer to be used to pay for out-of-pocket healthcare costs.

COBRA guarantees employees and their families the right to keep their group health insurance coverage when they would otherwise lose it after leaving their job.

A prior authorization is an acknowledgement by your health insurance company that a health care service is necessary before you receive the actual service.

If your health insurer refuses to cover a procedure, pay a claim or ends your coverage you have the right to ask them to reconsider their decision.

An external review is an appeal of a health insurer's decision to deny coverage for or payment of a service.

Copay And Coinsurance Together

If your Medicare Advantage plan denies you payment or medical services, don’t take it lying down.

Donut Hole refers to a prescription coverage gap found in Medicare (Part D) drug plans.