Analyze your spending habits If you never have made use of a budget before, you may have an idea. With our interactive budget calculator you can see how people like you in your zip code are budgeting based on factors including the number of adults and children in the household and the size of the household's annual income. Household Budget Basics. A budget lets you manage how much you're spending relative to how much you're earning. A home budget is a spending plan that accounts for the income and expenses of a household. To make your home budget, try tallying joint costs in a worksheet. Fillable and printable Household Budget Form 2021. Fill, sign and download Household Budget Form online on Handypdf.com.

Other templates:

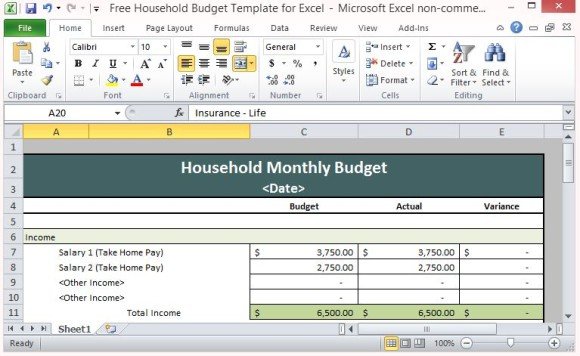

Monthly Household Budget

Monthly Household Budget- Home

- Utilities

- Transportation

- Insurance

- Debt payments

- Due date

- Month's name section

- Bill

- Date

- Amount

- Paid

- Income

- Expenses

- Utilities

- Notes

Simple Weekly Budget Template

Simple Weekly Budget Template- Extra

- Total

- Notes

- Daily section

- Planned budget

- Actual outcoming

- Difference

Free Household Budget Worksheet Printable

Monthly budget tracker- Month's name

- Date

- Description

- Amount

- Balance

- Total expense

- Monthly expenses

- Total income

- Difference

- Planned

- Notes

Household Budget 101

Colored monthly budget template- Bill payment

- Amount

- Due

- Monthly columns

- Bill payment

- Amount

- Due

- Monthly columns

- Checking

- Date due

- Savings

- Income

- Checking Deposits

- Actual Bills

- Total Income

- Total Expenses

- Goals

- Expenses

- Housing

- Debts

- Notes

Below is a sample monthly budget. A budget may be used to help you manage your money. It is an estimate of your income and expenses over a period of time. By creating and using a monthly budget, you can get a better idea of where you spend your money, to whom you owe money, and how much. It will help you focus on saving more, so you may reach your financial goals.

Sample Budget

This budget example has two categories, income and expenses. Income includes money earned, including wages. Expenses includes items you spend your money on, including rent and food.

The sample also has three columns, the first column, Monthly Budget Amount, is the budget estimate for the month. The next column, Actual Amount, is the actual income and expenses for the month. The final column, Difference, is the difference between the estimate and the actual budget (column 1 minus column 2).

MONTHLY BUDGET

| Category | Monthly Budget Amount | Actual Amount | Difference |

| INCOME: | |||

| Wages/Income | $872 | $810 | $62 |

| Interest Income | $232 | $196 | $36 |

| INCOME SUBTOTAL | $1,104 | $1,006 | $98 |

| EXPENSES: | |||

| Taxes | $386 | $397 | ($11) |

| Rent/Mortgage | $298 | $239 | $59 |

| Utilities | $99 | $95 | $4 |

| Groceries/Food | $121 | $100 | $21 |

| Clothing | $66 | $60 | $6 |

| Shopping | $55 | $46 | $9 |

| Entertainment | $44 | $44 | $0 |

| Miscellaneous/Other | $35 | $31 | $4 |

| EXPENSES SUBTOTAL | $1,104 | $1,012 | $92 |

| NET INCOME (Income – Expenses) | $0 | ($6) |

Note that in this budget, the actual income and expenses were both below the budget estimate (Monthly Budget Amount). Also, the person spent slightly more ($6) than they earned for the month. They may need to cut their expenses next month, unless they receive higher income. We would recommend that they add an additional row called ‘savings’ where they can budget for saving money every month.

Teaching Lessons:

Budget Lessons – Use these lessons to teach basic budget concepts. For teaching and learning household budgeting.

Related posts:

Household Budget Worksheet

- Preparing a Realistic Budget Whether you are a new couple just starting out or a family who has to...

- Family Budget Planning Budgeting is a bad word to some people. What do you think of when you hear...